There’s no video-version of WISER this week, but you can enjoy the playlist of previous WISERs here.

Estimated reading time: 4 minutes, 21 seconds

The price tag is only the beginning.

Every purchase carries a future cost: of money, time, and attention.

Wise choices consider not just what you buy, but what you’re committing to keep.

Spend wisely this January.

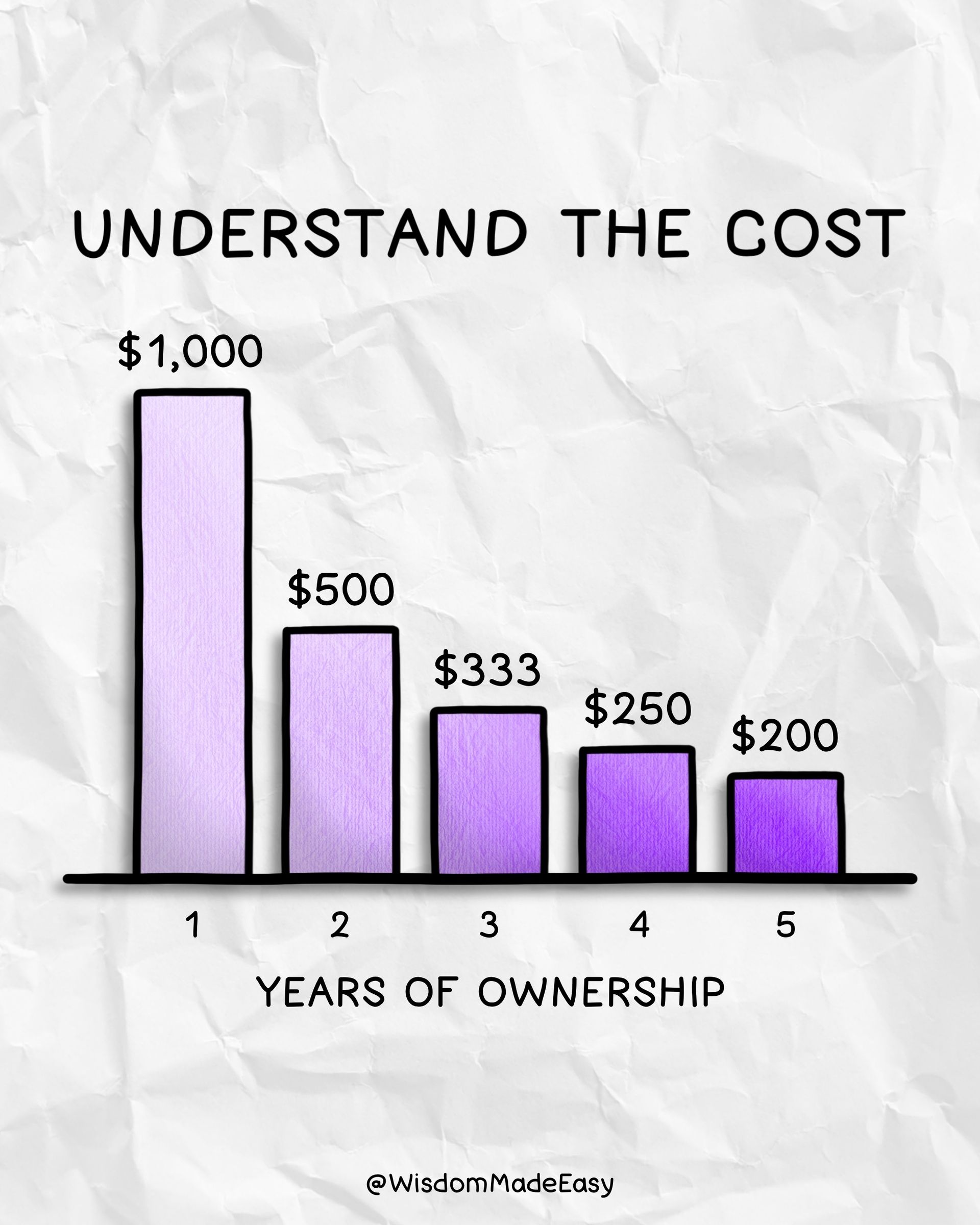

Today’s visual represents why you ought to consider more the true cost of ownership:

If you purchase a new $1,000 mobile phone every year, that is a cost of $1,000 every year.

But if you use that same $1,000 mobile phone for 5 years, it means that you’re essentially spending $200 on your mobile phone per year.

This principle doesn’t just apply to mobile phones: cars, laptops, cameras, and much, much more.

Where could this principle apply for you?

Beware of little expenses; a small leak will sink a great ship.

It’s not just the big, obvious costs that cause trouble.

It’s the quiet, ongoing ones we fail to account for that can cause devastating consequences too.

The discounts feel urgent. The “limited time only” banners shout at you. And suddenly, something you didn’t need in December feels oddly essential in January.

This isn’t about never buying nice things.

It’s about buying intentionally.

Because the real question isn’t: Can I afford this today?

It’s: Am I willing to own everything that comes with it tomorrow?

Here are three ways to think more clearly about the cost of ownership before you buy:

Consider how long you’ll own it.

Will this be something you use and enjoy for years, or something you’ll replace quickly?

Like today’s visual, a phone upgraded every year costs far more than one kept for five.

Longevity often matters more than the upfront deal.

Account for the hidden costs.

The price of the car is just the start.

There’s fuel, insurance, servicing, cleaning, repairs, and time.

The same goes for gadgets, subscriptions, clothes, and hobbies.

Ask: What does this cost me after I bring it home?

Time-travel before you buy.

Imagine yourself one week from now. One month from now.

Will this still excite you, or will it quietly blend into the background?

Future-you is often a better decision-maker than present-you caught in a sale.

Let’s dive deeper into today’s wisdom with these 3 journal prompts:

What recent purchase has cost me more than I expected over time?

What do I tend to underestimate when buying new things?

How could slowing down my buying lead to more satisfaction, not less?

Today I want to share a book recommendation: I Will Teach You To Be Rich.

This was the first book I bought on Audible when I was starting my personal development journey, and even as a UK resident, I found the financial principles that Ramit Sethi shares in this book incredibly helpful.

Ramit doesn’t teach extreme frugality - he teaches intentional spending.

This book helps you understand where your money actually goes, how to spend lavishly on what you love, and cut ruthlessly on what you don’t.

A perfect January read for anyone wanting to make smarter decisions about ownership, not just purchases.

⭐️ Rate This Week's Newsletter!

If you have any feedback on the WISER Newsletter, I would love to hear it! Simply reply to this email, and I will get back to you. Alternatively, just DM me on social media.

Catch you in the next issue!

Thanks,

Michael